Dig deeper or Dig through the noise. Be Bold, Dig for the best You and the best Family You!

Talking about Mortgage Rates is just part of the equation. To fully communicate client benefit you have to discuss mortgage rates in terms of effective rate if they itemize their tax returns.

Currently the tax code provides for mortgage interest deductibility. Contact your CPA if you are unsure if you can itemize with IRS Form Schedule A.

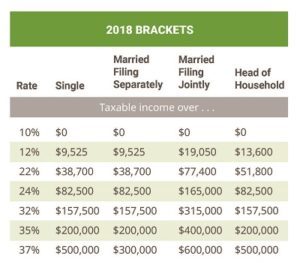

Consumers that itemize and deduct qualified mortgage interest should focus on their effective mortgage rate rather than note rate. The higher your tax bracket the greater the benefit and lower the effective cost of financing a home.

Effective Rate = (1-tax bracket) * Note Rate

A 5% note rate would have the following effective rate for the following:

22% Tax Bracket = 3.9% Tax Effect Rate (1.1% lower than 5% note rate)

37% Tax Bracket = 3.15% Tax Effect Rate (1.85% lower than 5% note rate)

Although mortgage lenders try to make you believe lenders have some special access to lower mortgage rates, the truth is we all get mortgage products from the same sources. What varies in the note rate stated by a lender’s sales person is the assumptions in pricing and yields that have not and may not be realized in servicing. The later has cost many mortgage lenders their bank and company when pricing too optimistically.

Instead of worrying about note rates which is set by the market, focus on the real savings provided by the IRS tax code. If you are buying a house, you will want to evolve from the 1040ez to 1040 and schedule A. Another great reason to buy a home!

Asking your loan Originator if they are Licensed will also ensure you get a Licensed Mortgage Originator. Bank Mortgage Originators do not take or pass the national and state competency test to originate. Consult your tax advisor if you have questions about tax deductibility.

[powr-hit-counter id=91d748a1_1558268780121]

I am not a big fan of canned quotes; however, this popped up and it resonated with me. It conveys a belief of mine and was the focal point of several conversations I had last week. I believe people should have the opportunity to grow their career and earnings each day they work rather than remaining status quo for years and decades due to complacency. “Without better soil, you will become pot bound and never growth no matter what you may be told. Great Talent Deserves Great Media to Grow.” Cal Haupt

Everyone talks about top Producers? Focusing on Top Earners would be a better ranking criteria for Mortgage Professionals.

People always ask me what SEM’s production is and I proudly tell them our Shareholders own the best margined business in the industry. Frankly, production does not pay the bills.

A Company’s ability to convert production to Revenue to Net Income is sustainability. No Debt and Vertical integration of services and functionality creates incredible efficiency so you can pay your team well and still post impressive earnings. Many Mortgage companies use bolt on services and non-direct secondary access which is expensive and wastes revenue.

If your margins are too tight and you fail to balance revenue to expense, your company will have to sell or close their doors as we continue to see. The key and art is to price at market and competitively adjust to earn your Partner’s business.

Over my 26 years, I have heard “my pay will blow your socks off”, “I make a lot”, etc. If you only play pick up basketball in your neighborhood and there was no TV or Internet, you would not realize there is an NBA.

Focus on what pays your bills. Trophies and Trips will not pay your bills. Earn and grow your business. Buy your own better travel experiences with better production to pay conversion. I know from personal experience none of the Bank Trips I won were half as cool as the travel I enjoy today.

Mortgage Originator’s are realizing they have to make changes with respect to what is the most beneficial goal for them. As our Originator population ages, preparing for a secure retirement has become a call to action.

Cal Haupt, Chairman and Chief Executive Officer, Southeast Mortgage of Georgia, Inc.

Volume – Pay Shift