March Jobless Claims 3.2 Million

4/2/2020 Jobless Claims 6.4 Million

4/9/2020 Jobless Claims

6.6 Million (Constraints to Consumer access – could have been higher)

Many mortgage originators are talking about FICO scores and DTI in the wake of the Covid-19 emergency. Whether it is apparent to mortgage originators or not, you can be assured the threat to the mortgage industry is not the more conservative program guidelines the industry is adopting; it is the Furloughs, Layoffs, and Terminations that will result from expense reduction strategies by those companies that shut their businesses down for our Country’s economic survival. The unemployment rate is going to spike over the next 30-60 days. Estimates indicate unemployment will reach 15% to 32%. In 1933 it was 24.9% which may foreshadow the potential impact unemployment will have on our economy. The peak unemployment during 2009 was only 10% and everyone remembers the defaults and the impact to the mortgage industry. The cause of the 2009 Great Recession? Risky unsustainable mortgage lending without regard for doing the “Right Thing”.

If you remember, everyone was on the option arm and sub-prime train during 2008-2009. Everyone sold “we have the programs to get you more buyers” etc. Defaults and the implosion that followed put a lot of great builders and mortgage professionals out of work.

This is different. Covid-19 will have a more severe impact for a shorter duration. My advice is do the right thing for your builder and realtor partners. This emergency will pass in 6 months or so and then you can add risk if you choose.

Job loss is going to be the biggest disruptor of mortgage closings and approvals over the next 3-6 months. The reason FICO and DTI is being adjusted industry wide is to narrow pipelines to borrowers who have a lower risk profile and better job stability.

The mortgage market has changed, and the bond and secondary markets are trying to process what the current normal is. Until there is visibility on the current normal and the Government can find the right level of MBS engagement, caution and complying with guidance is the safest path for your clients and partners.

Over promising only creates downstream risk for builder partners and realtors. Stating you can deliver programs that have overlays and unaffordable buy-downs in the hope of engineering a solution later, is not the right thing for a borrower or your partners. Being proactive today will stabilize pipelines and improve your probability of a successful closing tomorrow and 3 months from now. Employment status and probability of employment will be the underlying challenge as we overcome Covid-19 and restart our great economy.

Relationships: A connection established by a discovered harmonic connection of a similar kind.

Working together achieves more as a team than one individual or a group of individuals can in a non-harmonic production line. www.southeastmortgage.com/UGA | 770-750-HOME Text UGA to 800-344-8788

Getting uncomfortable and making the decision to commit to a better career and family life has its rewards.

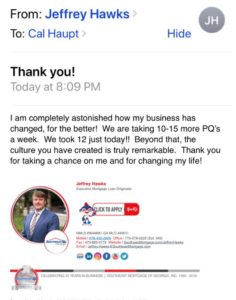

“Being reminded of how Southeast Mortgage helps leverage talented people makes my day. Our experience with newly hired Mortgage Originators is their production increases 30% on average due to our operations methodology, media, and sales support. Make the most of your career.” Cal Haupt

“I am completely astonished how my business has changed, for the better! We are taking 10-15 more PQ’s a week. We took 12 just today!! Beyond that, the culture you have created is truly remarkable. Thank you for taking a chance on me and for changing my life!” Jeffrey Hawks

We all know 2+2=4.

If your family’s future and your career depend on what 2+2 equals, you sleep well at night knowing the answer with certainty.

If your family’s future and your career depend on calculating the area under a curve, you may have some sleepless nights. Unlike 2+2, the variables that affect the area under a curve are not linear.

The Mortgage Business has constantly changing variables and you have to have certainty that your leadership can quantify the variables into an exact area aka outcome.

Everyone does not need to know how to calculate the area under a curve. Success only requires the team to know their part in the equation and trust the team accomplishes their respective task. Trust and respect is created when your team has a track record of being historically correct. Normally recessions determine the winners and losers; however, some careers do not have 7-10 years to find out.

Great sales people and great operations people are only as good as the team’s ability to adapt to the changing economy and environment. Being great requires a daily calculation of progress and ensuring certainty for the team and their family. Certainty eliminates stress and creates a great night’s sleep.

Cal Haupt, Chairman and Chief Executive Officer, Southeast Mortgage of Georgia, Inc.

Southeast Mortgage – The Official Home Loan Lender of The Georgia Bulldogs

Passion is a feeling of intense enthusiasm towards or compelling desire for something.

The other day I had someone ask me what my passion was. I have always been a believer in letting my actions state my beliefs and or intentions. A good person does not have to state they are a good, their actions should speak louder than words and the difference they make in someone’s life is the measure.

As I reflected on what I am passionate about, I realized passion evolves with one’s life cycle and is not mutually exclusive.

As a kid, my passion was bicycles and motorcycles or anything else I could go fast on with little concern for safety.

In high school, my passion was football and having fun with my friends. Football opened the door to attend Georgia Tech; however, staying there was another more important evolution that had to be undertaken.

In high school, my passion was football and having fun with my friends. Football opened the door to attend Georgia Tech; however, staying there was another more important evolution that had to be undertaken.

In college, my passion shifted from football to academics. I realized that the rest of my life depended on doing well in college and making it through Georgia Tech with the limited funds I had saved was a tenuous pursuit. Passion gets real when you will either sleep under a bridge or a roof. My path would be determined based on focus and my ability to obtain my degree. Reinventing myself from jock to a scholar was not easy; however, I always believed I could accomplish anything I set my mind to.

In college, my passion shifted from football to academics. I realized that the rest of my life depended on doing well in college and making it through Georgia Tech with the limited funds I had saved was a tenuous pursuit. Passion gets real when you will either sleep under a bridge or a roof. My path would be determined based on focus and my ability to obtain my degree. Reinventing myself from jock to a scholar was not easy; however, I always believed I could accomplish anything I set my mind to.

After graduating College, I learned valuable lessons about respect, team work, and how the economy works. Being the best was my passion after college. No matter what I was doing, I wanted to win with a singular focus like playing football. This mentality gave me glory; however, it created unintended collateral damage. As I matured and was provided some timely advice from my mentors, I realized sometimes you have to allow everyone around you to win before you can win in a sustained manner. Winning in business requires a team focus and slowing down before the finish line to help your teammates make it across the line with you. This creates a more robust win that builds a winning foundation instead of personal glory. A team win is by far the best glory and satisfaction I have experienced.

After a successful banking career and all the lessons both good and bad, my passion turned to Southeast Mortgage of Georgia, Inc., SEM. At first it was to show the Banking Industry and consumers there was a better mortgage origination business model that could be created between a Broker and Bank. All the knowledge I acquired at Georgia Tech and the Banks helped form a stable and effective production platform that disrupts competitors today. As my teammates from the banks began to join us at SEM, my passion evolved to proving my bank teammates made a great choice. I wanted to ensure SEM was a rewarding career and would be the last place they would have to work. They deserved to enjoy the benefits of ownership and secure their families future. Our days were normally 12 hours+ and many of us worked weekends. When we started to get a Sunday off, we thought that was incredible. For 15 years this was the routine, and we had a blast creating and evolving SEM into what it is today. I even enjoyed mowing our lawn at Club Drive until the shareholders said I was embarrassing them.

For the past 5 years, my passion is still focused on accomplishing the promise to my Shareholders. The evolution of my passion was bifurcated when my life was blessed with three little heart beats that will carry the Haupt name forward. They changed the way I view the world and simply made me a better person, manager, and friend.

For the past 5 years, my passion is still focused on accomplishing the promise to my Shareholders. The evolution of my passion was bifurcated when my life was blessed with three little heart beats that will carry the Haupt name forward. They changed the way I view the world and simply made me a better person, manager, and friend.

Technology and my talented leadership team allows me to balance my two passions today. After I accomplish my shareholder’s objectives, my full attention will be on mentoring my kids to be good humans that are kind, considerate, and have the experiences needed to understand the diversity of our civilization and prosper in it.

Embrace evolution and enjoy the ride!

Innovation or Cost Cutting are the two paths a Mortgage Company can take when volume slows or the economy creates a headwind.

The current recovery period after the Great Recession is now 10+ years. The average historical recession is 7-8 months.

In 2008 and 2009, most mortgage companies both Bank, Non-Bank, and Broker cut costs dramatically in an attempt to save their balance sheet and company. Banks lost the ability to use mortgages as tier one capital thus they moved away from the product line and cut thousands of jobs. Broker and Non-Bank LLCs (Limited Liability Companies with a few partners) kept what ever cash they had for themselves and closed. Brokers could not find product because the bank correspondents shut down wholesale. As a result, we all saw the Implode List literally explode with the names of the companies many thought were safe and well run.

Will this happen again? Yes. When? that is the unknown. I look at data and study patterns. Patterns repeat prior to recessions with some trigger that comes out of the blue.

The innovators and those that did follow the herd mentality cutting cost (good loyal people with families) survived the Great Recession and evolved to be a better company while filling the void left by imploded companies.

Cost cutters and those lowering rates to unsustainable levels just for volume all became an entry in the implode list. Today, we have companies following the same flawed strategies as those prior to 2008. The good news for the shareholders is a few banks have started to sell; however, cost cutting is inevitable with merger overlap and a lot of good people will be forced to evolve versus making their own choice to evolve.

The mortgage industry has a specific sweet spot that is key to longevity and profitability. I found there are three key elements that must exist to grow in recoveries and recessions.

1. Take care of your clients and put them in a product that meets their needs not your strategy.

2. Know your costs, know how to calculate proper pricing, and understand production regression analysis.

3. Add value to your Partners and help them grow their business. Monetary payments do not grow sales for the mortgage lender nor the Partner. Increase their social media presence and you increase their sales which increases the mortgage company’s application flow. Win-Win.

If you look at the history of any industry, complacency always costs good people their jobs. Because complacency feels safe and takes little effort, this short sighted view creates opportunity for others who are willing to take a new path and innovate. As one goes bye bye, another innovator emerges as the leader and fills the void. AOL – Google, Sears – Amazon, Blackberry – Apple, Magnovox – Samsung, Blockbuster – Netflix.

We are always innovating and evolving to stay relevant for our clients and partners. This is the only path for long term success whether from a company perspective or as an individual. Evolution is not easy and learning new ways requires getting uncomfortable and taking charge of your career not what others want you to do! Do you.

Banks continue to struggle in the Retail Mortgage Business. Profitability and Capital requirements are making Banks rethink the size of their mortgage operations. Smaller complimentary operations are probably the future banking norm. When banks see the retail mortgage business as a declining sector, new graduates, growing population, and a strong economy would suggest the opposite. IMO, Home Ownership is the American Dream and the cornerstone to America! I say it’s a surging industry and our sales would support my belief. GO America!!!! Read More Here.

Dig deeper or Dig through the noise. Be Bold, Dig for the best You and the best Family You!