March Jobless Claims 3.2 Million

4/2/2020 Jobless Claims 6.4 Million

4/9/2020 Jobless Claims

6.6 Million (Constraints to Consumer access – could have been higher)

Many mortgage originators are talking about FICO scores and DTI in the wake of the Covid-19 emergency. Whether it is apparent to mortgage originators or not, you can be assured the threat to the mortgage industry is not the more conservative program guidelines the industry is adopting; it is the Furloughs, Layoffs, and Terminations that will result from expense reduction strategies by those companies that shut their businesses down for our Country’s economic survival. The unemployment rate is going to spike over the next 30-60 days. Estimates indicate unemployment will reach 15% to 32%. In 1933 it was 24.9% which may foreshadow the potential impact unemployment will have on our economy. The peak unemployment during 2009 was only 10% and everyone remembers the defaults and the impact to the mortgage industry. The cause of the 2009 Great Recession? Risky unsustainable mortgage lending without regard for doing the “Right Thing”.

If you remember, everyone was on the option arm and sub-prime train during 2008-2009. Everyone sold “we have the programs to get you more buyers” etc. Defaults and the implosion that followed put a lot of great builders and mortgage professionals out of work.

This is different. Covid-19 will have a more severe impact for a shorter duration. My advice is do the right thing for your builder and realtor partners. This emergency will pass in 6 months or so and then you can add risk if you choose.

Job loss is going to be the biggest disruptor of mortgage closings and approvals over the next 3-6 months. The reason FICO and DTI is being adjusted industry wide is to narrow pipelines to borrowers who have a lower risk profile and better job stability.

The mortgage market has changed, and the bond and secondary markets are trying to process what the current normal is. Until there is visibility on the current normal and the Government can find the right level of MBS engagement, caution and complying with guidance is the safest path for your clients and partners.

Over promising only creates downstream risk for builder partners and realtors. Stating you can deliver programs that have overlays and unaffordable buy-downs in the hope of engineering a solution later, is not the right thing for a borrower or your partners. Being proactive today will stabilize pipelines and improve your probability of a successful closing tomorrow and 3 months from now. Employment status and probability of employment will be the underlying challenge as we overcome Covid-19 and restart our great economy.

Relationships: A connection established by a discovered harmonic connection of a similar kind.

Working together achieves more as a team than one individual or a group of individuals can in a non-harmonic production line. www.southeastmortgage.com/UGA | 770-750-HOME Text UGA to 800-344-8788

We all know 2+2=4.

If your family’s future and your career depend on what 2+2 equals, you sleep well at night knowing the answer with certainty.

If your family’s future and your career depend on calculating the area under a curve, you may have some sleepless nights. Unlike 2+2, the variables that affect the area under a curve are not linear.

The Mortgage Business has constantly changing variables and you have to have certainty that your leadership can quantify the variables into an exact area aka outcome.

Everyone does not need to know how to calculate the area under a curve. Success only requires the team to know their part in the equation and trust the team accomplishes their respective task. Trust and respect is created when your team has a track record of being historically correct. Normally recessions determine the winners and losers; however, some careers do not have 7-10 years to find out.

Great sales people and great operations people are only as good as the team’s ability to adapt to the changing economy and environment. Being great requires a daily calculation of progress and ensuring certainty for the team and their family. Certainty eliminates stress and creates a great night’s sleep.

Cal Haupt, Chairman and Chief Executive Officer, Southeast Mortgage of Georgia, Inc.

Innovation or Cost Cutting are the two paths a Mortgage Company can take when volume slows or the economy creates a headwind.

The current recovery period after the Great Recession is now 10+ years. The average historical recession is 7-8 months.

In 2008 and 2009, most mortgage companies both Bank, Non-Bank, and Broker cut costs dramatically in an attempt to save their balance sheet and company. Banks lost the ability to use mortgages as tier one capital thus they moved away from the product line and cut thousands of jobs. Broker and Non-Bank LLCs (Limited Liability Companies with a few partners) kept what ever cash they had for themselves and closed. Brokers could not find product because the bank correspondents shut down wholesale. As a result, we all saw the Implode List literally explode with the names of the companies many thought were safe and well run.

Will this happen again? Yes. When? that is the unknown. I look at data and study patterns. Patterns repeat prior to recessions with some trigger that comes out of the blue.

The innovators and those that did follow the herd mentality cutting cost (good loyal people with families) survived the Great Recession and evolved to be a better company while filling the void left by imploded companies.

Cost cutters and those lowering rates to unsustainable levels just for volume all became an entry in the implode list. Today, we have companies following the same flawed strategies as those prior to 2008. The good news for the shareholders is a few banks have started to sell; however, cost cutting is inevitable with merger overlap and a lot of good people will be forced to evolve versus making their own choice to evolve.

The mortgage industry has a specific sweet spot that is key to longevity and profitability. I found there are three key elements that must exist to grow in recoveries and recessions.

1. Take care of your clients and put them in a product that meets their needs not your strategy.

2. Know your costs, know how to calculate proper pricing, and understand production regression analysis.

3. Add value to your Partners and help them grow their business. Monetary payments do not grow sales for the mortgage lender nor the Partner. Increase their social media presence and you increase their sales which increases the mortgage company’s application flow. Win-Win.

If you look at the history of any industry, complacency always costs good people their jobs. Because complacency feels safe and takes little effort, this short sighted view creates opportunity for others who are willing to take a new path and innovate. As one goes bye bye, another innovator emerges as the leader and fills the void. AOL – Google, Sears – Amazon, Blackberry – Apple, Magnovox – Samsung, Blockbuster – Netflix.

We are always innovating and evolving to stay relevant for our clients and partners. This is the only path for long term success whether from a company perspective or as an individual. Evolution is not easy and learning new ways requires getting uncomfortable and taking charge of your career not what others want you to do! Do you.

Banks continue to struggle in the Retail Mortgage Business. Profitability and Capital requirements are making Banks rethink the size of their mortgage operations. Smaller complimentary operations are probably the future banking norm. When banks see the retail mortgage business as a declining sector, new graduates, growing population, and a strong economy would suggest the opposite. IMO, Home Ownership is the American Dream and the cornerstone to America! I say it’s a surging industry and our sales would support my belief. GO America!!!! Read More Here.

Vernon Chandler posted this image this morning. It reinforces an important belief that I live by. Vernon, Brandi, Jenna, Corey, Jeffrey and a few others had the opportunity to visit Cuba with a Partner of ours recently. Many would say they are too busy or my favorite TV show comes on tonight, SEM people embrace adventure and experiences. Complacency leaves the “Whatif” unanswered. Because we embrace new experiences and do not make excuses, we try new things. They now have some cool travel street credit. Americans who have visited Cuba and can speak first hand on a unique culture. The US has now closed that door. In life, some doors are only open for a finite time due to timing and opportunity aligning. Always explore, be bold, never regret.

Dig deeper or Dig through the noise. Be Bold, Dig for the best You and the best Family You!

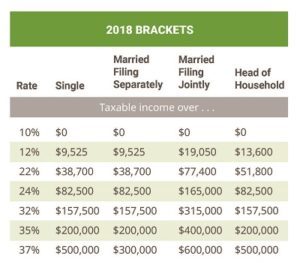

Talking about Mortgage Rates is just part of the equation. To fully communicate client benefit you have to discuss mortgage rates in terms of effective rate if they itemize their tax returns.

Currently the tax code provides for mortgage interest deductibility. Contact your CPA if you are unsure if you can itemize with IRS Form Schedule A.

Consumers that itemize and deduct qualified mortgage interest should focus on their effective mortgage rate rather than note rate. The higher your tax bracket the greater the benefit and lower the effective cost of financing a home.

Effective Rate = (1-tax bracket) * Note Rate

A 5% note rate would have the following effective rate for the following:

22% Tax Bracket = 3.9% Tax Effect Rate (1.1% lower than 5% note rate)

37% Tax Bracket = 3.15% Tax Effect Rate (1.85% lower than 5% note rate)

Although mortgage lenders try to make you believe lenders have some special access to lower mortgage rates, the truth is we all get mortgage products from the same sources. What varies in the note rate stated by a lender’s sales person is the assumptions in pricing and yields that have not and may not be realized in servicing. The later has cost many mortgage lenders their bank and company when pricing too optimistically.

Instead of worrying about note rates which is set by the market, focus on the real savings provided by the IRS tax code. If you are buying a house, you will want to evolve from the 1040ez to 1040 and schedule A. Another great reason to buy a home!

Asking your loan Originator if they are Licensed will also ensure you get a Licensed Mortgage Originator. Bank Mortgage Originators do not take or pass the national and state competency test to originate. Consult your tax advisor if you have questions about tax deductibility.

[powr-hit-counter id=91d748a1_1558268780121]

Everyone talks about top Producers? Focusing on Top Earners would be a better ranking criteria for Mortgage Professionals.

People always ask me what SEM’s production is and I proudly tell them our Shareholders own the best margined business in the industry. Frankly, production does not pay the bills.

A Company’s ability to convert production to Revenue to Net Income is sustainability. No Debt and Vertical integration of services and functionality creates incredible efficiency so you can pay your team well and still post impressive earnings. Many Mortgage companies use bolt on services and non-direct secondary access which is expensive and wastes revenue.

If your margins are too tight and you fail to balance revenue to expense, your company will have to sell or close their doors as we continue to see. The key and art is to price at market and competitively adjust to earn your Partner’s business.

Over my 26 years, I have heard “my pay will blow your socks off”, “I make a lot”, etc. If you only play pick up basketball in your neighborhood and there was no TV or Internet, you would not realize there is an NBA.

Focus on what pays your bills. Trophies and Trips will not pay your bills. Earn and grow your business. Buy your own better travel experiences with better production to pay conversion. I know from personal experience none of the Bank Trips I won were half as cool as the travel I enjoy today.

Mortgage Originator’s are realizing they have to make changes with respect to what is the most beneficial goal for them. As our Originator population ages, preparing for a secure retirement has become a call to action.

Cal Haupt, Chairman and Chief Executive Officer, Southeast Mortgage of Georgia, Inc.

Volume – Pay Shift