Talking about Mortgage Rates is just part of the equation. To fully communicate client benefit you have to discuss mortgage rates in terms of effective rate if they itemize their tax returns.

Currently the tax code provides for mortgage interest deductibility. Contact your CPA if you are unsure if you can itemize with IRS Form Schedule A.

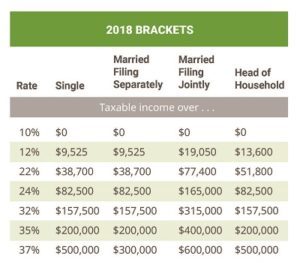

Consumers that itemize and deduct qualified mortgage interest should focus on their effective mortgage rate rather than note rate. The higher your tax bracket the greater the benefit and lower the effective cost of financing a home.

Effective Rate = (1-tax bracket) * Note Rate

A 5% note rate would have the following effective rate for the following:

22% Tax Bracket = 3.9% Tax Effect Rate (1.1% lower than 5% note rate)

37% Tax Bracket = 3.15% Tax Effect Rate (1.85% lower than 5% note rate)

Although mortgage lenders try to make you believe lenders have some special access to lower mortgage rates, the truth is we all get mortgage products from the same sources. What varies in the note rate stated by a lender’s sales person is the assumptions in pricing and yields that have not and may not be realized in servicing. The later has cost many mortgage lenders their bank and company when pricing too optimistically.

Instead of worrying about note rates which is set by the market, focus on the real savings provided by the IRS tax code. If you are buying a house, you will want to evolve from the 1040ez to 1040 and schedule A. Another great reason to buy a home!

Asking your loan Originator if they are Licensed will also ensure you get a Licensed Mortgage Originator. Bank Mortgage Originators do not take or pass the national and state competency test to originate. Consult your tax advisor if you have questions about tax deductibility.

[powr-hit-counter id=91d748a1_1558268780121]