Getting uncomfortable and making the decision to commit to a better career and family life has its rewards.

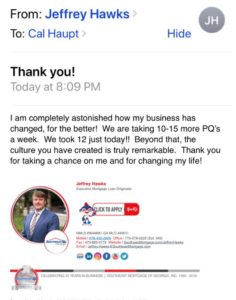

“Being reminded of how Southeast Mortgage helps leverage talented people makes my day. Our experience with newly hired Mortgage Originators is their production increases 30% on average due to our operations methodology, media, and sales support. Make the most of your career.” Cal Haupt

“I am completely astonished how my business has changed, for the better! We are taking 10-15 more PQ’s a week. We took 12 just today!! Beyond that, the culture you have created is truly remarkable. Thank you for taking a chance on me and for changing my life!” Jeffrey Hawks

Innovation or Cost Cutting are the two paths a Mortgage Company can take when volume slows or the economy creates a headwind.

The current recovery period after the Great Recession is now 10+ years. The average historical recession is 7-8 months.

In 2008 and 2009, most mortgage companies both Bank, Non-Bank, and Broker cut costs dramatically in an attempt to save their balance sheet and company. Banks lost the ability to use mortgages as tier one capital thus they moved away from the product line and cut thousands of jobs. Broker and Non-Bank LLCs (Limited Liability Companies with a few partners) kept what ever cash they had for themselves and closed. Brokers could not find product because the bank correspondents shut down wholesale. As a result, we all saw the Implode List literally explode with the names of the companies many thought were safe and well run.

Will this happen again? Yes. When? that is the unknown. I look at data and study patterns. Patterns repeat prior to recessions with some trigger that comes out of the blue.

The innovators and those that did follow the herd mentality cutting cost (good loyal people with families) survived the Great Recession and evolved to be a better company while filling the void left by imploded companies.

Cost cutters and those lowering rates to unsustainable levels just for volume all became an entry in the implode list. Today, we have companies following the same flawed strategies as those prior to 2008. The good news for the shareholders is a few banks have started to sell; however, cost cutting is inevitable with merger overlap and a lot of good people will be forced to evolve versus making their own choice to evolve.

The mortgage industry has a specific sweet spot that is key to longevity and profitability. I found there are three key elements that must exist to grow in recoveries and recessions.

1. Take care of your clients and put them in a product that meets their needs not your strategy.

2. Know your costs, know how to calculate proper pricing, and understand production regression analysis.

3. Add value to your Partners and help them grow their business. Monetary payments do not grow sales for the mortgage lender nor the Partner. Increase their social media presence and you increase their sales which increases the mortgage company’s application flow. Win-Win.

If you look at the history of any industry, complacency always costs good people their jobs. Because complacency feels safe and takes little effort, this short sighted view creates opportunity for others who are willing to take a new path and innovate. As one goes bye bye, another innovator emerges as the leader and fills the void. AOL – Google, Sears – Amazon, Blackberry – Apple, Magnovox – Samsung, Blockbuster – Netflix.

We are always innovating and evolving to stay relevant for our clients and partners. This is the only path for long term success whether from a company perspective or as an individual. Evolution is not easy and learning new ways requires getting uncomfortable and taking charge of your career not what others want you to do! Do you.

I am not a big fan of canned quotes; however, this popped up and it resonated with me. It conveys a belief of mine and was the focal point of several conversations I had last week. I believe people should have the opportunity to grow their career and earnings each day they work rather than remaining status quo for years and decades due to complacency. “Without better soil, you will become pot bound and never growth no matter what you may be told. Great Talent Deserves Great Media to Grow.” Cal Haupt

Everyone talks about top Producers? Focusing on Top Earners would be a better ranking criteria for Mortgage Professionals.

People always ask me what SEM’s production is and I proudly tell them our Shareholders own the best margined business in the industry. Frankly, production does not pay the bills.

A Company’s ability to convert production to Revenue to Net Income is sustainability. No Debt and Vertical integration of services and functionality creates incredible efficiency so you can pay your team well and still post impressive earnings. Many Mortgage companies use bolt on services and non-direct secondary access which is expensive and wastes revenue.

If your margins are too tight and you fail to balance revenue to expense, your company will have to sell or close their doors as we continue to see. The key and art is to price at market and competitively adjust to earn your Partner’s business.

Over my 26 years, I have heard “my pay will blow your socks off”, “I make a lot”, etc. If you only play pick up basketball in your neighborhood and there was no TV or Internet, you would not realize there is an NBA.

Focus on what pays your bills. Trophies and Trips will not pay your bills. Earn and grow your business. Buy your own better travel experiences with better production to pay conversion. I know from personal experience none of the Bank Trips I won were half as cool as the travel I enjoy today.

Mortgage Originator’s are realizing they have to make changes with respect to what is the most beneficial goal for them. As our Originator population ages, preparing for a secure retirement has become a call to action.

Cal Haupt, Chairman and Chief Executive Officer, Southeast Mortgage of Georgia, Inc.

Volume – Pay Shift