Innovation or Cost Cutting are the two paths a Mortgage Company can take when volume slows or the economy creates a headwind.

The current recovery period after the Great Recession is now 10+ years. The average historical recession is 7-8 months.

In 2008 and 2009, most mortgage companies both Bank, Non-Bank, and Broker cut costs dramatically in an attempt to save their balance sheet and company. Banks lost the ability to use mortgages as tier one capital thus they moved away from the product line and cut thousands of jobs. Broker and Non-Bank LLCs (Limited Liability Companies with a few partners) kept what ever cash they had for themselves and closed. Brokers could not find product because the bank correspondents shut down wholesale. As a result, we all saw the Implode List literally explode with the names of the companies many thought were safe and well run.

Will this happen again? Yes. When? that is the unknown. I look at data and study patterns. Patterns repeat prior to recessions with some trigger that comes out of the blue.

The innovators and those that did follow the herd mentality cutting cost (good loyal people with families) survived the Great Recession and evolved to be a better company while filling the void left by imploded companies.

Cost cutters and those lowering rates to unsustainable levels just for volume all became an entry in the implode list. Today, we have companies following the same flawed strategies as those prior to 2008. The good news for the shareholders is a few banks have started to sell; however, cost cutting is inevitable with merger overlap and a lot of good people will be forced to evolve versus making their own choice to evolve.

The mortgage industry has a specific sweet spot that is key to longevity and profitability. I found there are three key elements that must exist to grow in recoveries and recessions.

1. Take care of your clients and put them in a product that meets their needs not your strategy.

2. Know your costs, know how to calculate proper pricing, and understand production regression analysis.

3. Add value to your Partners and help them grow their business. Monetary payments do not grow sales for the mortgage lender nor the Partner. Increase their social media presence and you increase their sales which increases the mortgage company’s application flow. Win-Win.

If you look at the history of any industry, complacency always costs good people their jobs. Because complacency feels safe and takes little effort, this short sighted view creates opportunity for others who are willing to take a new path and innovate. As one goes bye bye, another innovator emerges as the leader and fills the void. AOL – Google, Sears – Amazon, Blackberry – Apple, Magnovox – Samsung, Blockbuster – Netflix.

We are always innovating and evolving to stay relevant for our clients and partners. This is the only path for long term success whether from a company perspective or as an individual. Evolution is not easy and learning new ways requires getting uncomfortable and taking charge of your career not what others want you to do! Do you.

Talking about Mortgage Rates is just part of the equation. To fully communicate client benefit you have to discuss mortgage rates in terms of effective rate if they itemize their tax returns.

Currently the tax code provides for mortgage interest deductibility. Contact your CPA if you are unsure if you can itemize with IRS Form Schedule A.

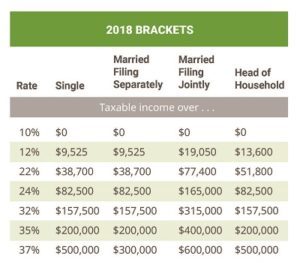

Consumers that itemize and deduct qualified mortgage interest should focus on their effective mortgage rate rather than note rate. The higher your tax bracket the greater the benefit and lower the effective cost of financing a home.

Effective Rate = (1-tax bracket) * Note Rate

A 5% note rate would have the following effective rate for the following:

22% Tax Bracket = 3.9% Tax Effect Rate (1.1% lower than 5% note rate)

37% Tax Bracket = 3.15% Tax Effect Rate (1.85% lower than 5% note rate)

Although mortgage lenders try to make you believe lenders have some special access to lower mortgage rates, the truth is we all get mortgage products from the same sources. What varies in the note rate stated by a lender’s sales person is the assumptions in pricing and yields that have not and may not be realized in servicing. The later has cost many mortgage lenders their bank and company when pricing too optimistically.

Instead of worrying about note rates which is set by the market, focus on the real savings provided by the IRS tax code. If you are buying a house, you will want to evolve from the 1040ez to 1040 and schedule A. Another great reason to buy a home!

Asking your loan Originator if they are Licensed will also ensure you get a Licensed Mortgage Originator. Bank Mortgage Originators do not take or pass the national and state competency test to originate. Consult your tax advisor if you have questions about tax deductibility.

[powr-hit-counter id=91d748a1_1558268780121]